Renovating your home can be as exciting as it is daunting, especially when it comes to budgeting. From initial costs to long-term value, there are key factors every homeowner should consider before jumping into renovations. Here’s what you need to know, including insights on financing, choosing contractors, and understanding how these changes might impact property taxes. Let’s dig into the essentials for savvy budgeting in your home makeover journey!

1. Financing Your Renovation Dreams

One of the first steps in your renovation journey is figuring out how to finance it. Here are some popular ways to fund home renovations:

- Home Equity Loans: Ideal for larger projects, home equity loans offer a lump sum based on your home’s equity. Keep in mind, though, this is secured against your property, so it’s crucial to ensure manageable payments.

- Personal Loans: If you prefer a shorter-term option without touching your home’s equity, personal loans might be suitable, though they often come with higher interest rates.

- Cash-Out Refinance: For homeowners with significant equity, a cash-out refinance can provide substantial renovation funds, though it replaces your existing mortgage. This could increase your overall debt but may provide a lower interest rate compared to personal loans.

Property Focus offers a detailed Financial Transaction History in our property reports, allowing homeowners to review past financing, like mortgage amounts and refinancing events, helping to evaluate if a cash-out refinance could work for your renovation plans.

2. Setting a Realistic Renovation Budget

Here’s where most homeowners encounter challenges: creating a budget that fits both your vision and your wallet. Here are some guidelines:

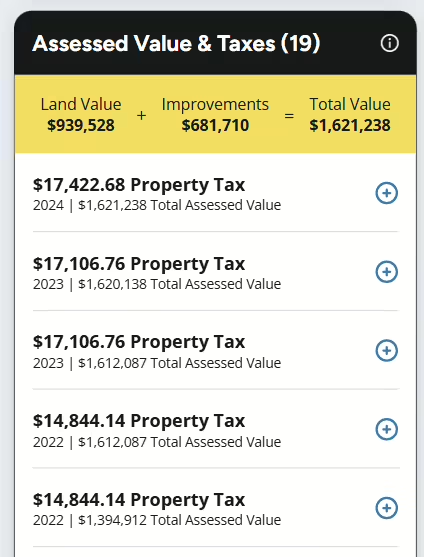

- Assess the Property’s Value: Start by examining your property’s current assessed value. For example, in our sample report for a California property, the total assessed value is over $1.6 million, with about $700,000 attributed to improvements. Knowing how much of your property’s value is tied to land versus improvements can help in setting a realistic budget, as some upgrades (like structural improvements) will increase this total more than cosmetic changes.

- Prioritize High-Value Areas: Kitchens, bathrooms, and exterior improvements typically offer the best return on investment. Aim to budget for renovations that will enhance property value and appeal, which also contributes to a favorable assessed improvement value in your next tax assessment.

- Factor in Unexpected Costs: It’s common for renovations to go slightly over budget due to unexpected findings. Add a contingency fund—typically 10-15% of your budget—to cover these surprises.

3. Choosing the Right Contractors

Selecting the right contractor is key to achieving your renovation goals on time and within budget. Here’s how to approach it:

- Gather Multiple Quotes: Aim to get at least three quotes to compare costs and timelines. Don’t just go for the lowest bid; evaluate each contractor’s track record, recommendations, and understanding of the project.

- Check Their Licenses: Verify that your contractor has a valid license and insurance. This protects you from liability and ensures they meet local standards. Many Property Focus reports offer insights into licensed businesses in your area, providing context on local contractor availability and reputation.

- Use a Clear Contract: Ensure that your contract outlines costs, timelines, materials, and expectations. A well-defined contract prevents misunderstandings and sets a clear framework for accountability.

4. Understanding Property Tax Implications

Many homeowners overlook the impact that renovations can have on property taxes, but this is an important factor to keep in mind for long-term budgeting:

- Increased Assessed Value: Major upgrades, like adding a room or remodeling a kitchen, can boost your home’s assessed improvement value, often resulting in higher property taxes. For instance, in our example property in California, the current assessed improvement value stands at around $700,000. If a homeowner adds a new room or undertakes a full kitchen renovation, the improvement value could increase significantly—possibly by 10-15%, depending on local rates. This would mean an increase of around $70,000 to $105,000 in assessed value, potentially raising the overall property tax owed each year.

- Renovation Permits and Assessments: Many counties require permits for certain renovations, which can trigger a reassessment of your property’s value. This reassessment can lead to a new tax rate based on the improvements. Using data from your Property Focus report, such as land use designation and Assessor’s Parcel Number (APN), helps streamline the permit process. For instance, the land use code, like Single Family Residence in our California example, indicates the types of renovations allowed under zoning laws, while the APN uniquely identifies the property to county authorities. Suppose you’re planning a kitchen remodel with added square footage; referencing the APN ensures that permits are filed accurately and the improvements are legally recorded. As these updates may increase the assessed improvement value (and subsequently, property taxes), preparing with land use and APN data helps ensure smooth permitting and minimizes surprises at tax time.

5. Maximizing the Value of Your Renovation

Every homeowner wants to know that their renovations are adding value to their property. Some tips to ensure a positive return:

- Focus on “Big Wins”: Look at high-impact projects like new flooring, updated bathrooms, or an open-concept layout to attract future buyers. Property Focus reports can help you gauge how similar homes in your area have been updated or improved, giving you insight into what works best for your local market.

- Match Your Neighborhood: While it can be tempting to add luxury finishes, it’s essential to stay in line with neighborhood standards. Upgrading too far above the average may lead to a lower return on investment. Property Focus’s neighborhood data can provide a comparative snapshot, helping you keep renovations proportional to surrounding properties.

Final Thoughts

Budgeting for a home renovation is an exercise in balancing dreams with reality. By starting with a solid financing plan, setting a clear budget, selecting reliable contractors, and understanding property tax implications, you’ll be well-prepared to achieve your renovation goals. For more insights, Property Focus’s detailed property reports can be a valuable tool, offering the latest data on property assessments, neighborhood trends, and ownership history to guide you through every stage of your renovation journey. Happy renovating!