Refinancing can be a strategic move for homeowners, offering potential savings on interest or adjustments to monthly payments. However, it also influences key financial aspects like the loan-to-value (LTV) ratio, property value, and future sale potential. We’ll also explore how these elements connect, using insights from a Property Focus report to help guide us.

Understanding Refinancing and Its Impact on Loan-to-Value (LTV) Ratio

The LTV ratio, calculated as the loan amount divided by the property’s appraised value, serves as an essential indicator for both lenders and homeowners. High LTV ratios might limit refinancing options or increase interest rates, while a lower LTV generally offers better terms.

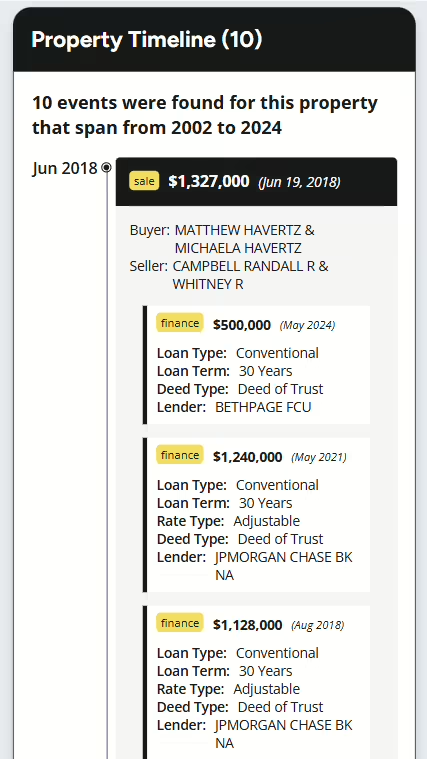

In the case of our example property in California, it was initially purchased for $1,327,000 in 2018 with a mortgage of approximately $1,128,000, resulting in an initial LTV of around 85%. Refinancing events, such as a 2021 adjustable-rate refinance to a $1,240,000 loan with JPMorgan Chase, impacted the LTV. Each refinance affects the owner’s equity, especially if it increases the principal loan amount.

The 2021 refinance of this property involved taking out an adjustable-rate mortgage of $1,240,000. With an estimated property value of $1,612,000 at the time (based on the most recent assessed value), this refinance resulted in a loan-to-value (LTV) ratio of approximately 77% ($1,240,000 / $1,612,000). In this case, the refinance effectively lowered the LTV, reflecting an increase in equity due to property appreciation. This adjustment in LTV improves the homeowner’s financial flexibility, potentially offering more favorable lending terms in future refinances or sales.

How Refinancing Affects Property Value Perception and Appraisal

Refinancing doesn’t directly change your property’s market value, but it influences the perception of value through recent appraisals. Refinancing typically requires an updated appraisal, which could reflect market trends, property upgrades, or local real estate shifts. In Property Focus reports, you can monitor property values over time, seeing how refinances and appraisals align with property sales in the neighborhood.

Consider our example property in California: Over the years, appraisals and tax assessments show increasing assessed values, with a total assessed value rising from about $834,000 in 2018 to $1,612,000 in 2023. Each increase not only reflects market conditions but also gives a financial snapshot that potential future buyers might interpret as part of the property’s intrinsic value.

Refinancing’s Effect on Future Sale Potential

- Increased Debt Load: When refinancing leads to a higher loan amount, as seen in the 2021 refinance on our example, the homeowner’s equity percentage reduces. This can impact future sales by narrowing profit margins, especially if the market value does not increase proportionally.

- Market Comparisons: Buyers often compare properties based on appraised or assessed values, which Property Focus conveniently tracks. For instance, nearby properties and their sales prices help to establish realistic expectations for potential buyers.

- Enhanced Property Appeal: Sometimes, refinancing allows for home improvements that can increase market appeal and, potentially, the selling price. If funds from a cash-out refinance, for example, are used for remodeling, future buyers might value the property higher due to added features.

Loan Terms and Interest Rates: Future Buyer Considerations

Interest rates or terms from past refinances are not directly part of the property’s value. However, for potential buyers, seeing that a property has been refinanced several times could hint at a high-maintenance investment or even financial struggles of the current owner, which might influence their offer.

Leveraging Property Focus for Strategic Refinancing and Selling Decisions

With Property Focus, homeowners can monitor all property events, including refinancing, appraisals, and sales in the neighborhood. This allows you to assess how refinancing could affect your current LTV, evaluate local market trends, and ultimately decide if refinancing aligns with your long-term goals.

In conclusion, refinancing can be a valuable tool for financial flexibility, but understanding how it impacts your LTV, perceived property value, and future sale potential is essential for making the most of your investment. With tools like Property Focus, you can gain the insights needed to make informed refinancing and selling decisions.