Accurately pricing your home is crucial when entering the real estate market. Whether you’re selling or buying, understanding the factors that impact property valuation ensures you get the best deal possible. In this article, we’ll break down the essential factors that influence home valuations and show you how to use a property report to guide your pricing strategy effectively.

1. Tax Assessments: A Baseline for Value

Tax assessments provide a starting point for understanding a property’s value. The assessed value is typically set by local tax authorities and is used to calculate property taxes. However, the assessed value often differs from the current market value due to its use for taxation rather than sale purposes.

For example, imagine a home assessed at $1.6 million in 2023, with a land value of $900,000 and an improvement value of $700,000. The annual property tax for that year amounted to just over $17,000. While the assessed value provides a helpful reference, it is important to combine this information with current market data to get a more accurate selling price.

Tax assessments provide a stable starting point for setting a price, even though they may not always align with market values. Here’s how they help:

- Baseline Pricing: The assessed value offers a conservative estimate that you can adjust based on market trends and property upgrades.

- Property Growth: Reviewing past assessments shows value increases over time, helping gauge market appreciation.

- Comparison with Neighbors: Comparing your property’s assessment with nearby homes can highlight potential for price adjustments, especially in high-demand areas.

- Valuing Upgrades: The breakdown of land vs. improvement value helps you assess how renovations impact your home’s worth.

- Market Cross-Check: Significant gaps between assessed and market values can indicate pricing opportunities or warn against overpricing.

Using a property report like those from Property Focus, you can track tax assessment trends over the years to see how the value has changed. For instance, comparing the property’s tax assessments from previous years can help you spot patterns of appreciation or stagnation, allowing you to set a competitive price that aligns with the market.

2. Sales History: Tracking Market Trends

The sales history of a property is one of the most critical factors in pricing your home. Understanding the past sale prices of your home, along with the prices of similar properties in the neighborhood, gives you insights into how the market has evolved.

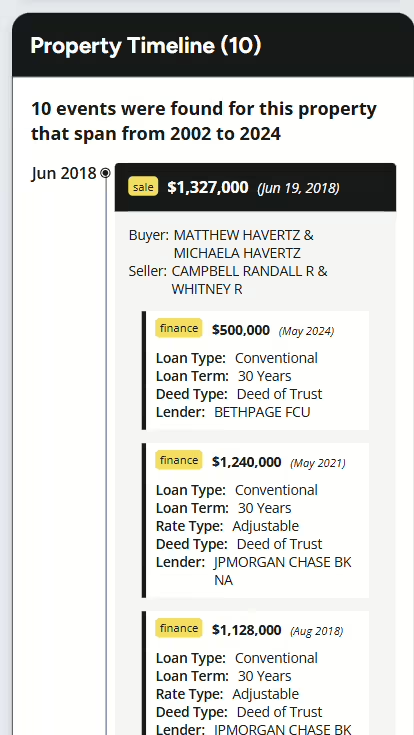

For instance, the aforementioned example property was sold for $1.3 million in 2018, up from $770,000 in 2012. This sharp increase reflects rising home values in the area. This significant increase in value over six years reflects a strong upward trend in that areas housing market. By analyzing similar sales data for comparable homes in your area, you can set a realistic price that reflects current demand and the historical growth of property values.

Property Focus makes it easy to view the entire sales timeline of a home, giving you detailed information about when a property was sold, at what price, and the conditions surrounding the transaction, such as whether it was a cash purchase or involved financing. Comparing the time gaps between sales and the percentage of value growth helps set the right price for your property in the current market environment.

3. Financing Events and Property Timeline: Insights into Ownership Costs

The Property Timeline in a Property Focus report is a useful tool for understanding a property’s financial history, especially if the home has gone through multiple loans, refinancing, or major improvements. These events can affect the property’s overall value and offer insights into the owner’s investment in the property.

For example, the timeline for a property may reveal a 30-year mortgage from a major lender, along with multiple refinancing events. These financial actions might suggest that the owners were able to increase the property’s value over time, which could influence how much you price or bid on the property.

When reviewing financing events, look for indications of major refinancing or large loans, as they can often signal significant improvements or renovations that might have enhanced the property’s market value. If a home has been refinanced multiple times, it may also suggest that the owner took advantage of favorable market conditions to increase their investment in the property. Understanding these financing events allows you to assess the true value of a home beyond just sales prices and tax assessments.

4. Market Trends: Keep an Eye on the Bigger Picture

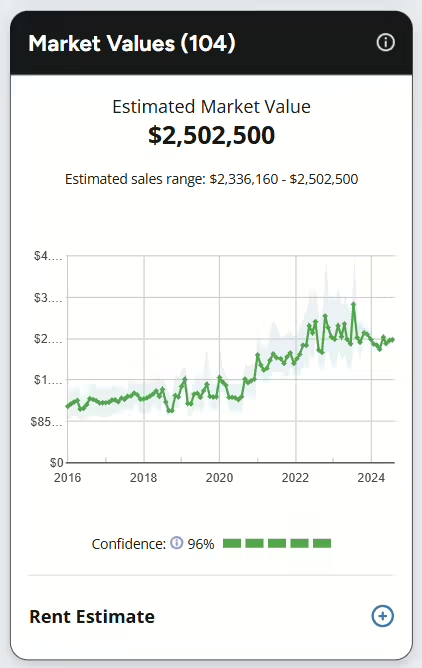

In addition to property-specific data, market trends play a major role in determining the value of your home. Are prices in the area rising or falling? Is there high demand for homes in your neighborhood?

For example, a property might currently have an estimated market value of $2.5 million, based on recent local sales. This figure represents the current market trend and can help you set your asking price at a realistic level. With Property Focus Report Monitoring, you can monitor changes in estimated market values, helping you adjust your pricing as conditions evolve. Always keep a weathered eye on similar properties in your area. By tracking the broader real estate market, you can ensure that your pricing is competitive and aligned with what buyers are willing to pay.

5. Property Condition and Building Attributes

The condition and specific attributes of a home are essential factors that can significantly affect its market value. A property’s size, layout, and physical characteristics, such as the number of bedrooms and bathrooms, directly influence how buyers perceive its worth.

But beyond the basics, unique features and overall condition can either elevate or diminish its value. The quality of construction, age of the home, and any modern updates or renovations—such as a newly remodeled kitchen or updated energy-efficient windows—can further increase the property’s attractiveness and overall price.

In the case of a home that was built in the 1950s, the original condition of key features like the roof, plumbing, or electrical systems could impact its value. If the property has had recent improvements or maintenance, such as a new roof or modern HVAC system, those upgrades can justify a higher asking price. These are important considerations for buyers who are looking to avoid immediate renovation costs.

When pricing your property, it’s essential to compare it with similar homes in the area. Does it have comparable features, or are there unique attributes that add value? Using a Property Focus report, you can get detailed data on the property’s square footage, room count, and quality, making it easier to determine how your home stacks up against others in the market.

Conclusion

By leveraging tools like Property Focus, which provides detailed property reports, you can make informed pricing decisions based on key data like tax assessments, sales history, and market trends.

Understanding property valuation is a multifaceted process that involves examining tax assessments, sales history, financing events, and current market conditions. Tools like Property Focus make it easy to gather and analyze these factors, providing you with a comprehensive view of your property’s value. By leveraging this data, you can accurately price your home to match market expectations, ensuring a successful sale or purchase.