When searching for a new home, most buyers focus on location, price, and square footage. But one crucial factor that can significantly affect your decision is the ownership history of the property. As a buyer in 2024, you’re more empowered than ever, with access to detailed property reports (like the ones you get with Property Focus) that can give you a comprehensive view of a home’s past. Understanding how past sales, deed types, and ownership changes can influence the value and stability of a property is key to making an informed decision. Here’s how you can use this information to your advantage during your home search and be the best buyer you can be!

Why Ownership History is Important for Buyers

The ownership history of a property offers valuable insights into its past, including how frequently it changed hands and what legal or financial circumstances may have influenced those transactions. A detailed look into a home’s past can reveal whether the property has been well-maintained or if there might be potential red flags, such as legal issues or financial instability.

For example, a house in California shows a clear record of ownership changes and mortgage details from as far back as 2005. Long-term, consistent ownership with stable mortgages often indicates proper upkeep and financial security, while frequent refinancing or ownership changes could signal underlying issues. This transparency helps you, as a buyer, better understand the property’s financial history, maintenance, and potential risks. In competitive markets, these insights can give you an edge over other buyers.

How Sale History Influences Property Value

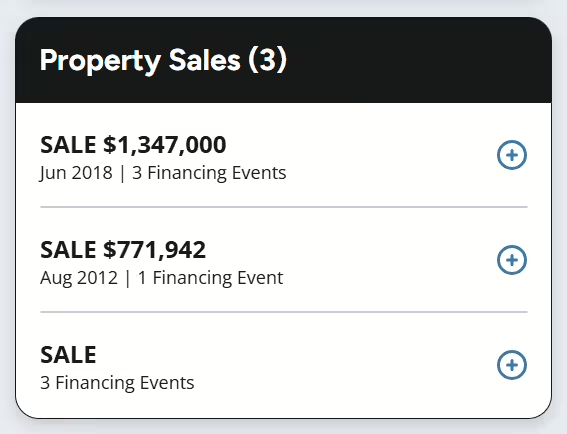

One of the first things you should examine is the sale history of the property. How many times has the home been sold, and for how much? Frequent sales over short periods could be a red flag, indicating potential issues with the property or the neighborhood. Conversely, long-term ownership can signal t in a desirable area.

For example, the aforementioned property in California was sold for just over $770,000 in 2012, and then resold in 2018 for $1.3 million. This appreciation in value over six years is a positive indicator for buyers, suggesting that the home is located in a thriving market. The property has experienced significant appreciation in a relatively short period, indicating strong market growth and the potential for future value increases, making it a potentially sound investment for buyers. A well-documented sale history can help you gauge the property’s potential for future appreciation, making it a safer investment.

The Impact of Deed Types on Your Purchase

As a buyer, it’s essential to understand the types of deeds that have been used in previous transactions. Warranty deeds provide a guarantee that the seller has full ownership and the right to transfer the property, giving you peace of mind that the title is clear. On the other hand, quitclaim deeds transfer ownership without any guarantees, which could indicate potential risks regarding the property’s legal status.

Using Property Focus, you can easily view the types of deeds associated with past sales. For instance, the California home mentioned earlier had a traditional deed of trust associated with its sale in 2018, backed by a conventional mortgage. This indicates a reliable and secure transaction, which should give you confidence as a buyer.

Mortgage and Financing History: What It Tells You

The mortgage history of a property is another critical area to investigate. Has the property been refinanced multiple times? Are there any unusually large mortgages compared to the home’s value? These could signal financial instability or difficulty in maintaining the property. Properties with a straightforward mortgage history, on the other hand, are often better maintained and easier to purchase without complications.

In the example of the California home, a review of the property’s mortgage history reveals a conventional mortgage with a 30-year adjustable rate issued by JPMorgan Chase in 2018. This consistency in financing can signal that previous owners were financially stable and that the property is unlikely to have significant hidden issues. As a buyer, knowing that the property has a stable financing background can help you feel more secure in your investment.

Refinancing Events and Ownership Transitions

Frequent refinancing or ownership transitions might suggest that the property was used for investment purposes or that previous owners faced financial difficulties. These transitions could affect your buying experience, especially if the property was poorly maintained between owners or if the home was sold quickly after a refinancing event. With tools like Property Focus, you can see any refinancing events and assess whether they could be a cause for concern.

The Importance of Transparency and Data-Driven Decisions

In 2024, buyers are increasingly focused on transparency and market stability. With rising interest rates and fluctuating market conditions, having access to comprehensive property data can make or break your decision. Buyers today are not just looking at surface-level details but are delving deep into the financial and legal histories of properties before making offers.

With the market becoming more data-driven, using platforms like Property Focus to access ownership history, sale details, and deed types can help you gain a competitive edge. The more informed you are, the more likely you are to make a successful investment.

How Property Focus Can Help Buyers

A platform like Property Focus offers buyers a powerful tool to review a property’s ownership and financial history. With features such as the Property Timeline, you can see a comprehensive view of all past transactions, including sales, deed types, and mortgages.

- Ownership History: See how often the property has changed hands and for how much. Long-term ownership is often a good sign for buyers, as it can indicate property stability.

- Deed Types: Check whether the property has a history of secure transactions using warranty deeds or if there have been riskier transfers with quitclaim deeds.

- Financial History: Review the mortgage history to ensure the property has been financed through reputable lenders without unusual refinancing events.

By using Property Focus, you can uncover critical insights into a property’s background that may not be immediately visible in standard listings. This information empowers you to negotiate better and avoid potential pitfalls, ensuring you make the best possible investment.

The Value of Ownership History in 2024 Property Purchases

In 2024, understanding a property’s ownership history is essential for assessing its value and identifying potential risks. As buyers become more data-savvy, platforms like Property Focus provide access to detailed records, including sale history, deed types, and financing details, offering valuable insights to make informed decisions. By leveraging this information, you can better evaluate a property’s future potential and ensure your next home purchase is a secure investment.