Investing in single-family versus multi-family properties presents distinct advantages and challenges. Using Property Focus reports, we’ll examine the financial considerations, cash flow dynamics, and strategic potential of each property type to help investors and real estate professionals assess which asset class aligns with their portfolio goals.

1. Acquisition Costs and Financing

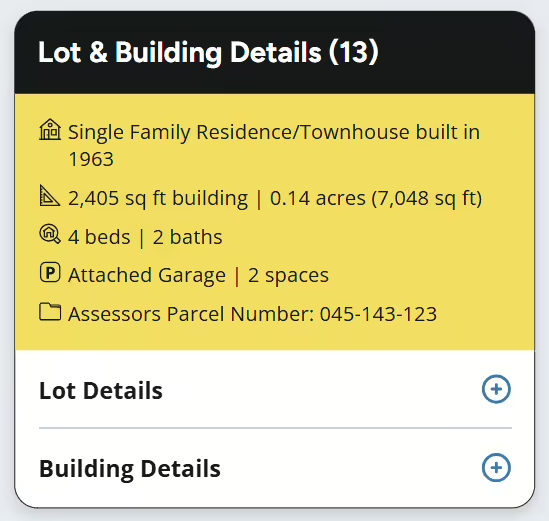

- Single-Family Homes: Single-family residences often require a lower initial investment compared to multi-family properties. These properties are typically more accessible for newer investors, and financing can be more straightforward with favorable loan terms and lower down payment requirements. Single-family homes are also easier to liquidate individually, providing greater flexibility for capital redeployment.

- Multi-Family Properties: Multi-family assets demand higher upfront capital but offer multiple revenue streams. Financing for multi-family investments generally involves more stringent underwriting, often requiring investors to demonstrate management experience and larger down payments. However, for well-capitalized investors, multi-family assets provide the opportunity for economies of scale and a potential hedge against vacancy risk.

2. Cash Flow Potential

- Single-Family Homes: Single-family rentals provide cash flow dependent on consistent occupancy, appealing to tenants seeking long-term housing stability. However, income can fluctuate with vacancies, and profitability hinges on effective tenant retention and property condition. This asset class can produce favorable cash flow when optimized with strategic leasing practices and property maintenance, although the income remains linear with a single unit.

- Multi-Family Properties: Multi-family investments offer significant cash flow potential by aggregating rental income from multiple units, thus minimizing the impact of individual vacancies on overall revenue. Such properties are ideal for investors focused on yield stability, and they benefit from efficient operational management to reduce per-unit maintenance costs.

3. Appreciation and Long-Term Value Growth

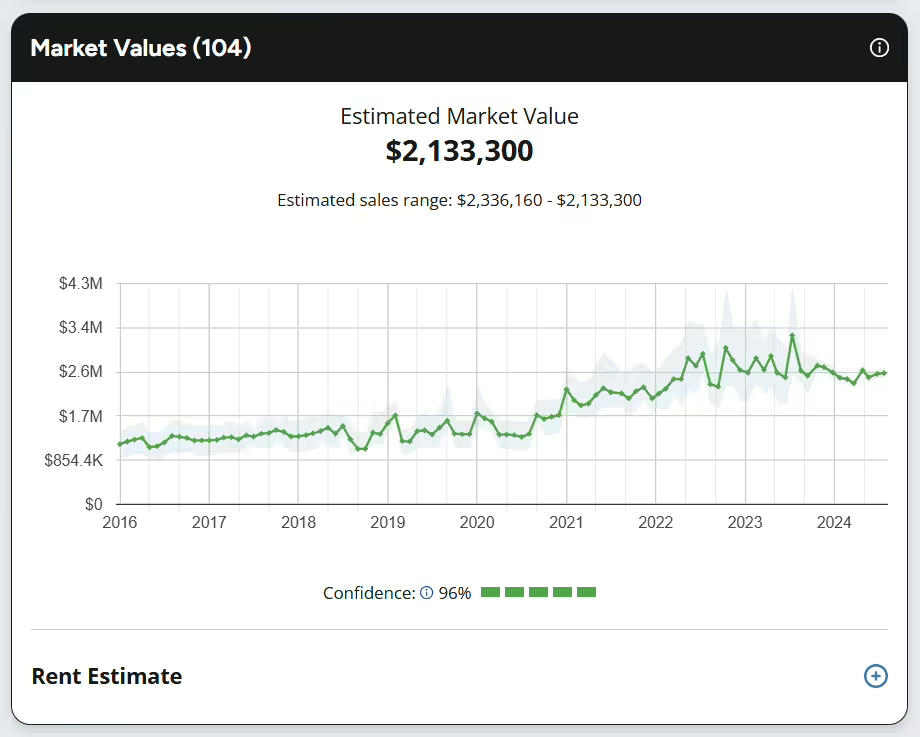

- Single-Family Homes: Single-family properties tend to appreciate steadily, driven largely by owner-occupant demand, especially in suburban and high-demand areas. For example, the California housing market has seen appreciation that positions single-family homes as a potential vehicle for long-term growth. Investors can realize substantial returns, particularly in areas with constrained housing supply and favorable demographic trends.

- Multi-Family Properties: Multi-family properties generally experience appreciation based on income potential rather than traditional housing demand. Their valuation correlates strongly with rental income trends and operational efficiency, providing a more stable appreciation pattern. This makes multi-family assets resilient, particularly in markets with steady rental demand, though they may be less susceptible to market-driven value spikes seen in single-family homes during housing booms.

4. Maintenance and Operational Considerations

- Single-Family Homes: Maintenance requirements for single-family rentals are often manageable, typically involving fewer tenants and more predictable upkeep. This asset type is conducive to self-management, allowing investors to mitigate operational costs. However, unexpected major repairs—like roofing or foundation work—can impact cash flow due to a lack of additional income sources within the property.

- Multi-Family Properties: Multi-family assets require rigorous, proactive management, particularly for larger buildings, which are subject to intensive, ongoing maintenance needs. However, these properties often benefit from economies of scale in maintenance operations. For instance, a three-story building with multiple units has scalable maintenance efficiencies that can improve the property’s NOI (Net Operating Income) and ultimately its valuation. Many investors employ third-party management, which can optimize tenant satisfaction and occupancy rates, enhancing cash flow.

5. Market Resilience and Vacancy Risks

- Single-Family Homes: Single-family homes generally maintain strong demand from both renters and buyers, especially in suburban areas, which can offer greater stability. This demand provides a level of liquidity and flexibility for investors to pivot between leasing and selling based on market conditions. However, vacancy risks can be challenging since there is no alternative income source within a single-family property if it remains unoccupied.

- Multi-Family Properties: Multi-family investments, particularly in urban centers with high rental demand, provide insulation against vacancy-driven cash flow disruptions. These properties’ income diversification across multiple units creates a buffer, allowing investors to absorb individual unit vacancies without severely impacting overall revenue. Multi-family investments are particularly resilient in economic downturns as they often benefit from rental demand in periods of decreased homebuying activity.

6. Tax Efficiency and Deductions

- Both asset types offer considerable tax benefits, including mortgage interest deductions, depreciation, and capital expense write-offs. Multi-family properties allow for enhanced tax efficiency by multiplying these deductions across multiple units. Additionally, expenses related to property management, maintenance, and improvements can be leveraged to reduce taxable income, providing strategic advantages for portfolio-focused investors.

Final Considerations for Investors

- Single-Family Properties: Ideal for investors prioritizing long-term appreciation and flexibility, single-family homes serve as reliable assets for markets with high owner-occupant demand. They offer a manageable entry point and greater liquidity but may require proactive management to mitigate income volatility from vacancies.

- Multi-Family Properties: For seasoned investors with access to substantial capital, multi-family properties deliver strong cash flow potential and operational efficiencies. These assets are well-suited for markets with consistent rental demand, offering income diversification, scalability, and resilience.

Using Property Focus’s comprehensive property reports, investors can analyze critical data such as historical sales, neighborhood trends, and property assessments to make informed investment decisions. Whether single-family or multi-family, aligning property types with portfolio goals and market insights is essential to maximizing long-term return on investment.