When purchasing a home, choosing the right mortgage is a critical decision that can significantly affect your financial future. Whether you’re a first-time buyer or seasoned investor, the choice between a fixed-rate mortgage (FRM) and an adjustable-rate mortgage (ARM) plays a key role in shaping your monthly payments and long-term costs. Let’s break down these two mortgage types and explore what information you need to understand the implications of each option.

What is a Fixed-Rate Mortgage (FRM)?

A fixed-rate mortgage is exactly what it sounds like: the interest rate remains consistent for the entire term of the loan, which is typically 15, 20, or 30 years. This predictability makes budgeting easier since your monthly payments for principal and interest will never change, regardless of fluctuations in market rates.

Advantages of Fixed-Rate Mortgages:

- Stability: You’ll know exactly how much you’ll pay each month, which is helpful for long-term financial planning.

- Protection against rising interest rates: Even if market interest rates increase, your rate remains unchanged.

Consider a homeowner who took out a fixed-rate mortgage in 2005 for $130,000 with an interest rate of 5.75%. Over the years, while market interest rates have fluctuated—sometimes rising to as much as 7% or higher—this homeowner’s monthly payments have remained consistent, providing valuable financial stability.

While a fixed-rate mortgage provides stability and predictability, it does come with some potential downsides. The primary drawback is that fixed-rate mortgages generally have higher initial interest rates compared to adjustable-rate mortgages (ARMs). This means homeowners may end up paying more in interest over the life of the loan, especially if market rates drop after securing the mortgage, as they did in 2008. Additionally, if you plan to sell or refinance your home within a few years, you might miss out on the potential cost savings offered by a lower-rate ARM during that initial period. For those with short-term housing plans or an expectation of falling interest rates, a fixed-rate mortgage might not offer the best financial advantage.

What is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage (ARM), on the other hand, features an interest rate that changes periodically based on market conditions. Typically, an ARM offers a lower initial rate compared to a fixed-rate mortgage, but after an introductory period, the rate adjusts at set intervals, often annually.

Advantages of Adjustable-Rate Mortgages:

- Lower initial payments: ARMs often offer lower rates for the first few years, which could be ideal for short-term buyers expecting their income to increase.

- Potential for savings if rates drop: If market rates fall, your mortgage payments may decrease.

For a homeowner who secured an adjustable-rate mortgage (ARM) in 2018 with an initial rate of 4.54%, the initial payments were relatively low compared to fixed-rate options at that time. When the Federal Reserve reduced rates in 2019, the average ARM rate dropped to 3.94%, which provided significant savings for those with adjusting ARMs. For instance, if the loan on the property was $200,000, this drop in interest rates could have reduced monthly payments by about $60, adding up to $720 in savings per year. However, by 2022, inflation pushed rates up sharply, and ARM holders may have seen their rates rise. This illustrates both the advantages and risks of ARMs: while they offer savings during periods of falling interest rates, they also carry the potential for increased payments when rates rise.

How a Property Timeline Can Help You Make Informed Decisions

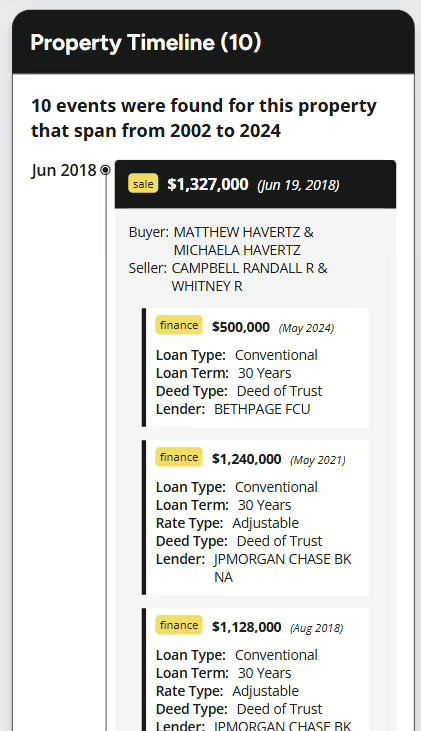

Property Focus provides essential details about a property’s financial history, including loan types, terms, and interest rates. For instance, a recent property focus report for a property in California reveals the current owner’s use of both fixed and adjustable-rate mortgages. The owner initially secured a 30-year fixed-rate loan, but later refinanced to a 30-year adjustable-rate mortgage. This refinancing allowed for lower initial payments but introduced variability in monthly costs after the initial fixed period.

With Property Focus’s Property Timeline feature, users can access a property’s financial history, including details about past mortgages, refinancing events, and loan types. This timeline offers valuable insight into how past owners financed the property, helping potential buyers better understand the financial trends and make informed decisions.

Other Loan Types

In addition to fixed-rate and adjustable-rate mortgages, there are several other mortgage options that homebuyers can explore. FHA loans, backed by the Federal Housing Administration, are popular among first-time buyers due to their lower down payment requirements and more lenient credit standards. VA loans, available to veterans and active military personnel, offer favorable terms like no down payment and no private mortgage insurance (PMI). Jumbo loans are used for higher-priced properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. Each mortgage type has distinct advantages depending on the borrower’s financial situation and property goals.

Conclusion: Which Option is Best for You?

With Property Focus, you can analyze past financial strategies employed by previous owners—such as how they leveraged lower rates through refinancing. Buyers can assess current market trends and choose the most suitable mortgage type. For example, if a report shows repeated refinancing into ARMs during times of declining rates, a buyer might consider the flexibility of an ARM, while fixed-rate mortgages could be better suited for long-term stability.

The choice between a fixed-rate mortgage and an adjustable-rate mortgage depends on your financial situation and long-term plans. If stability and predictability are your top priorities, a fixed-rate mortgage is a safe bet. However, if you are comfortable with some level of risk and aim to take advantage of lower initial rates, an adjustable-rate mortgage might be the right choice.