Refinancing your mortgage is a significant financial decision, and timing is everything. For homeowners considering this step, key factors like current interest rates, home equity, and long-term financial goals can make a difference between maximizing savings and missing opportunities. Here’s a look at what to consider when deciding if now is the time to refinance.

1. Evaluate Current Interest Rates

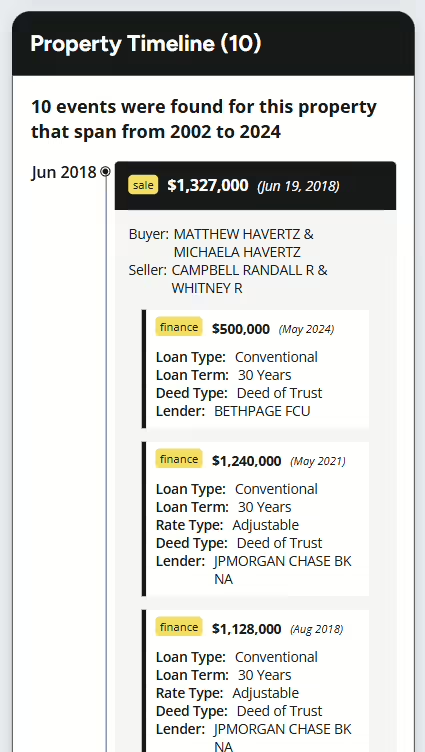

Interest rates are a primary driver for most homeowners when it comes to refinancing. If rates have dropped since you originally financed your mortgage, you could secure a lower monthly payment by refinancing. Interest rates fluctuate based on market conditions, and securing a lower rate can be the primary motivation for refinancing. Taking the example of a property in California, let’s assume the homeowner currently has a mortgage from 2021 with a rate of 4.5%. If today’s rates have dropped to 3.5%, refinancing would reduce interest payments significantly over time.

For a $1,240,000 mortgage on a 30-year term, here’s how refinancing from a 4.5% to a 3.5% interest rate could impact monthly payments:

- Initial Monthly Payment (4.5% rate): $6,282.90

- New Monthly Payment (3.5% rate): $5,568.15

- Monthly Savings: $714.74

This example shows a reduction of $714.74 per month, highlighting how refinancing at a lower rate can lead to substantial savings over time.

2. Build Up Home Equity

Equity is the value of your property minus the remaining balance on your mortgage. Generally, having more than 20% equity in your home strengthens your refinance application and may even help you avoid private mortgage insurance (PMI). With Property Focus’s financing timeline, you can review how equity in your property has evolved based on historical value estimates and loan balances. This feature provides a broader understanding of your property’s financial health, helping you make informed decisions about refinancing options like cash-out refinancing for renovations or debt consolidation.

3. Financial Goals: Lower Monthly Payments vs. Shorter Loan Terms

Refinancing offers various paths depending on your financial objectives:

- Lower Monthly Payments: If reducing monthly payments is a priority, refinancing into a mortgage with a longer term can stretch your balance over more years, bringing down your payments. However, this option may increase the total interest paid over the loan’s life.

- Shorter Loan Terms: Alternatively, refinancing to a shorter loan term—say from a 30-year to a 15-year mortgage—can significantly reduce your interest payments, though monthly payments may increase. This is an excellent choice for homeowners aiming to build equity quickly.

4. Debt Consolidation Through Cash-Out Refinancing

If you’re managing high-interest debt, cash-out refinancing can be a practical way to use your home equity to consolidate and pay off debts like credit cards or student loans at a lower interest rate. By consulting the Property Focus refinancing timeline in your report, you can explore past refinancing events, including cash-out refinances, associated with your property. This view provides insights into how other property owners have utilized similar strategies and helps you assess if a cash-out refinance could support your financial goals, potentially leading to lower monthly payments and simpler debt management.

5. Consider Timing and Costs

When refinancing, it’s essential to weigh the costs involved against the potential long-term savings. Refinancing typically comes with fees that range from 2% to 5% of the loan amount, including expenses such as:

- Application Fees: Lenders may charge fees just to process your refinancing application.

- Origination Fees: A fee for the lender’s work in creating your new loan, often around 1% of the loan amount.

- Appraisal Fees: Lenders require an updated appraisal to confirm your home’s current value, which generally costs between $300 and $600.

- Title Search and Insurance: This involves verifying your property’s title and issuing a new title insurance policy, which can cost several hundred dollars.

- Closing Costs: Other miscellaneous fees at closing may include recording fees, credit report charges, and attorney fees, all adding to the total.

Make Informed Decisions with Property Focus

Whether you’re aiming to lower your monthly payments, pay off your mortgage sooner, or consolidate debt, timing your refinance is crucial. Use tools like Property Focus to guide your refinancing journey confidently, and remember that well-timed refinancing can lead to substantial long-term savings and financial stability.